Analysis of the cost structure of amorphous silicon thin film photovoltaic cells

The most promising of thin-film photovoltaic cells is amorphous silicon thin film photovoltaic cells. Amorphous silicon materials are formed by vapor deposition. The currently widely used method is plasma enhanced chemical vapor deposition (PECVD). This manufacturing process can be continuously performed in a plurality of vacuum deposition chambers, thereby achieving mass production. Since the reaction temperature is low, it can be produced at a temperature of about 200 ° C. Therefore, a film can be deposited on a glass, a stainless steel plate, a ceramic plate, or a flexible plastic sheet, which is easy to be produced in a large area and has a low cost.

Compared with crystalline silicon photovoltaic cells, amorphous silicon thin film photovoltaic cells have good low light response and high charging efficiency. The absorption coefficient of amorphous silicon material is almost one order of magnitude larger than that of single crystal silicon in the whole visible light range, so that amorphous silicon photovoltaic cells have better adaptation to low light intensity both in theory and in practice. More and more practical data also show that when the peak power is the same, the specific power generation of amorphous silicon photovoltaic panels is greater than that of single crystal silicon and amorphous silicon under the conditions of direct sunlight and cloudy light and weak scattered light in sunny days. Thin film photovoltaic cells. More data shows that under the same environmental conditions, the annual power generation per kW of amorphous silicon photovoltaic cells is 8% higher than that of single crystal silicon and 13% higher than that of polycrystalline silicon.

The most important advantage of thin film photovoltaic cells is the cost advantage. According to estimates by many companies and institutions, even at a production scale of 5MW, the production cost of amorphous silicon thin film solar cell modules is below US$2/W, while the single-line production capacity reaches 40MW-60MW or even more fully automated production lines. The production cost of its products is even lower. Compared with the average international market price of 3.5 US dollars / watt, the profit margin can be imagined.

The main problems affecting the application of amorphous silicon thin film solar cells are low efficiency and poor stability. Compared to crystalline silicon cells, the cell area per watt is approximately doubled, limiting its application in situations where installation space and illumination area are limited. The instability is reflected in the fact that its energy conversion efficiency varies with the irradiation time, and it is not stable until hundreds or thousands of hours. This problem has affected the application of this low-cost solar cell to some extent.

Because the objective conditions are different at different times and in different places, the specific data in the figure is not static. Under some special conditions, even larger adjustments may be needed. However, some problems revealed by the above analysis should be It has a universal reference value.

Editor's point of view: In the face of investment fever, you need to think calmly

In the solar PV investment boom, silicon thin film photovoltaic cells seem to be a hot spot in the hot spot. Some experts pointed out that thin-film photovoltaic cells will grow at an average annual growth rate of about 50% in the next five to ten years, and will account for more than 30% of the total solar battery share by 2030.

However, silicon thin film solar cells are not an industry that does not make a profit. In addition to the risks in the market, cost and technology, there are high thresholds in terms of capital demand, supply chain organization, production power supply and technical talents.

In terms of capital requirements, the total investment of a 40MW-50MW amorphous silicon thin film battery production facility is about 1 billion yuan, and the recognized economic scale should be 300MW-500MW. This requires investors not only to raise enough initial investment, but also to prepare for continued investment in the next two or three years.

In terms of supply chain organization, there are only limited sources of supply for ultra-clear glass, high-purity silane, etc. required for production. Manufacturers must ensure a stable and inexpensive supply of materials. Otherwise, the battle for silicon materials in recent years will inevitably be repeated.

Technical talent has always been one of the bottlenecks in the development of thin film solar cells. In addition to the structural design, analysis and testing of the battery itself requires a large number of professionals, special processes such as chemical vapor deposition, vacuum sputtering, laser engraving, and factory support systems including a variety of special gases, high purity water, purification air conditioning systems, etc. Both require a large number of employees with professional knowledge and practical experience. Since a large number of projects are currently being built, the competition for attracting talents has become unprecedentedly fierce.

In short, the rise of investment in silicon thin film solar cells has become an indisputable fact. However, every enterprise that wants to participate in it should comprehensively analyze the opportunities and challenges that it faces, fully estimate the benefits and risks, and make its own investment decisions rationally and objectively. This is also the basis for the healthy and sustainable development of the industry.

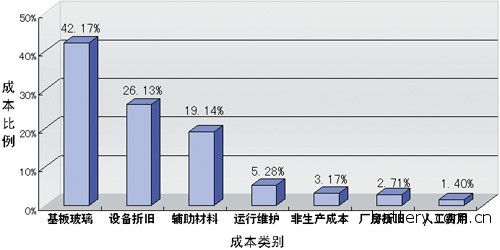

Figure 1 shows one of the results of the cost composition analysis. As can be seen from the figure, only the cost of the substrate glass and other auxiliary materials accounts for more than 60% of the total cost. Therefore, corporate decision-makers should focus on the cost of raw materials. At the beginning of the decision-making, they should conduct careful and meticulous research on the source, quality, supply conditions and price trends of raw materials. In terms of internal management, measures should be taken to ensure that the main The utilization rate of raw materials increases the overall yield and effectively reduces material consumption.

Internal rate of return is one of the important indicators for measuring the economic benefits of investment projects. According to current market conditions, the internal rate of return for a 40MW-60MW silicon thin film battery production line project is much greater than the industry benchmark yield of 12%. Despite this, market and technical uncertainties can pose significant risks to investment. Therefore, we also focused on the sensitivity analysis of the internal rate of return of the project during model simulation. The results of the analysis are shown in Figure 2. The selling price of the product is the most sensitive factor. In fact, this is not surprising. The benefits of any product production are directly determined by sales revenue and product cost. For solar cells, the photoelectric conversion efficiency of the product is also an important factor in determining the sales price of the battery components. If the price per watt of solar cells is assumed to be constant, when the photoelectric conversion efficiency is increased from 6% to 6.5%, the sales price of one component is increased by 8%, and the production cost is almost the same, which obviously will be the project. The benefits have a big impact.

Quartz Banger Glass Water Pipe,Blue Glass Water Pipe,Glass Water Piep With Color,Glass Rigs For Smoking

HEBEI DINGSHUO GLASSWARE CO.,LTD , https://www.dsglasspipe.com